The order continues relief in a previous executive order and in the CARES Act to extend from September 30 a deferral on student loan payments and 0 percent interest rate through December 31. Defer student loan payments and interest through December 31.Because most of these taxes would be repaid later, we estimate a deficit impact of roughly $5 billion. It is not clear how many employers would choose to defer withholding of taxes that they will still owe, but we estimate that up to $100 billion could be delayed. The employer-side payroll taxes (both Social Security and Medicare) are already deferred, at an employer's discretion, by the CARES Act. The Treasury Department is instructed to defer the withholding and payment of the 6.2 percent Social Security tax paid by employees for any employee making less than approximately $100,000 annually. Defer employee-side Social Security taxes that would be paid from September through December 31.Because the money was already appropriated to the Disaster Relief Fund, some by the CARES Act and some by previous legislation, this money could have been spent already so choosing it to spend on unemployment will have no additional deficit impact. We estimate that the program would have sufficient funding for five weeks of benefits (through August 29). As of June 30, about 25 percent of these funds had already been spent, though states may have allocated a much greater share to future costs. The enhanced benefits go through the first week in December, or until funds expire. Like other disaster funding, states would be required to provide a 25 percent match, for which the order encourages states to use their unspent funds from of the Coronavirus Relief Fund, or other state funds, for their $15 billion. Governors could request the additional funds from the Federal Emergency Management Agency. Increase unemployment benefits by $400/week ($300 funded by the federal government). The executive order would redirect up to $44 billion of existing funding within the Disaster Relief Fund to create a new program to pay an additional $400 per week to those already receiving at least $100 per week through state unemployment benefits.The three memoranda and one executive order are summarized below:

However, because these funds were already appropriated, there is no additional deficit impact from spending them on unemployment benefits rather than another purpose. *$44 billion would be spent from the Disaster Relief Fund. Source: CRFB estimates based on Congressional Budget Office estimates, data from the Departments of Treasury and Labor. Identify and review existing authorities to assist renters and homeowners Increase unemployment benefits by $400/week ($300 funded by the federal government), through December 6 or as long as funding lasts (we estimate 5 weeks)ĭefer employee-side Social Security taxes that would be paid from September 1 - December 31ĭefer student loan payments and interest through December 31 In particular, the cost of unemployment provisions and payroll tax deferral will depend on final regulations issued, and the actions of various states and employers. The orders were released today, and their ultimate cost depends on many details yet to be determined. These estimates are rough and preliminary, and will be revised as more information becomes available. Because much of the money was already allocated and deferred taxes would be paid later, however, the net cost will likely total $10 billion absent further policy changes. We estimate that these four orders will provide approximately $165 billion of near-term funds. President Trump signed four memos and executive orders this afternoon increasing unemployment benefits, deferring payroll taxes, extending student loan deferral, and discussing housing assistance.

As a result, we estimate the total near-term impact is $165 (rather than $225) billion. We also slightly reduced our student loan estimate.

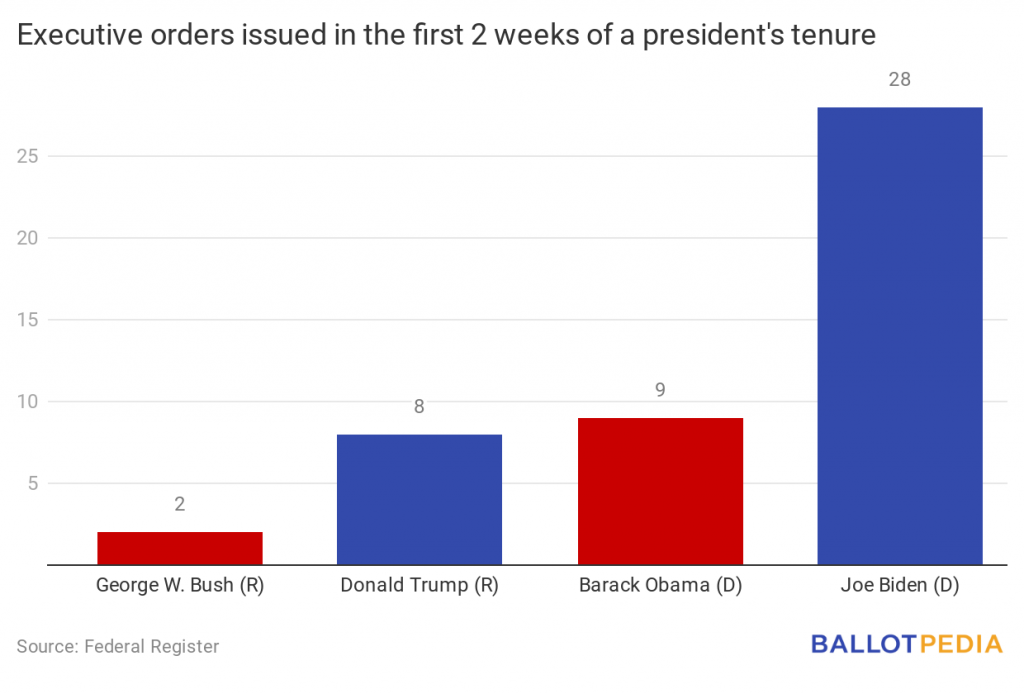

#NUMBER OF EXECUTIVE ORDERS BY PRESIDENT TRUMP UPDATE#

Update 8/10/20: We have revised our estimates downward to reflect our understanding from the final text of the memorandum that the payroll tax deferral is available only to workers who make less than $4,000 biweekly rather than only wages below $4,000.

0 kommentar(er)

0 kommentar(er)